Executive Summary:

-

Home sales activity in Los Angeles finally picked up pace in April, up 1 percent after 15 months of year-over-year declines.

-

The increase is driven by more sales of lower price segments, with sales below $1 million up 2 percent after 19 months of declines and sales priced between $1 million and $2 million up 8 percent. Higher-priced sales continue to trend lower off last year’s peaks.

-

The increase in activity is mostly coming from the East side of Los Angeles, including NELA, San Gabriel, and the East Valley, but also Beverly Hills on the West side.

-

Malibu continues to struggle after the wildfires, although demand for homes priced below $1 million has picked up. The region also suffers from a lack of inventory as it deals with fire lots.

-

While the number of homes for sale is tracking 10 percent above last year, homes have been sitting longer on the market. New listings in April declined 2 percent year-over-year.

-

Nevertheless, home buying activity is picking up pace with units under contract up 8 percent year-over-year in April, marking the second consecutive increase after a year of declines.

-

Largest increase in contracts is among homes priced below $1 million, particularly in Eastern parts of the city, namely NELA, South of 210, the East side, Foothills, and Pasadena, but also in Beverly Hills.

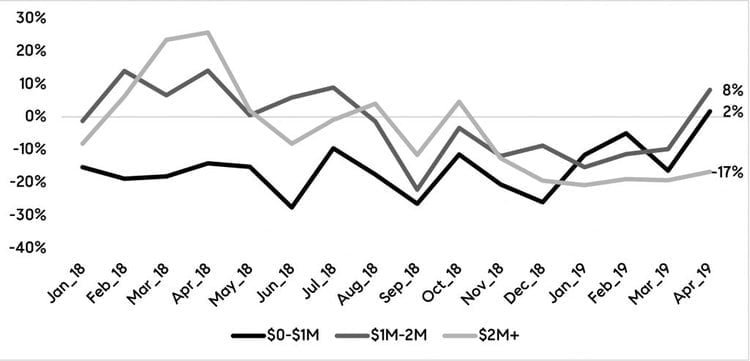

After doldrum housing market activity in Los Angeles through the first quarter of 2019, April has finally brought some cheer. Number of homes sold compared to last year increased 1 percent overall, mostly driven by increases in sales of homes priced between $1 and $2 million (up 8 percent), and sales of homes priced below $1 million (up 2 percent). Higher priced homes (above $2 million) continue to trend below last year’s levels, but are still ahead compared to 2017 and 2016. 2018 saw a surge in higher-priced sales activity. Figure 1 illustrates trends in year-over-year changes of the number of homes sold by price range. Encouragingly, sales of homes priced below $2 million saw growth after an extended period of double-digit declines, especially among homes priced below $1 million which have been on a decline since July 2017.

Figure 1: Year-over-year change in number of homes sold by price range

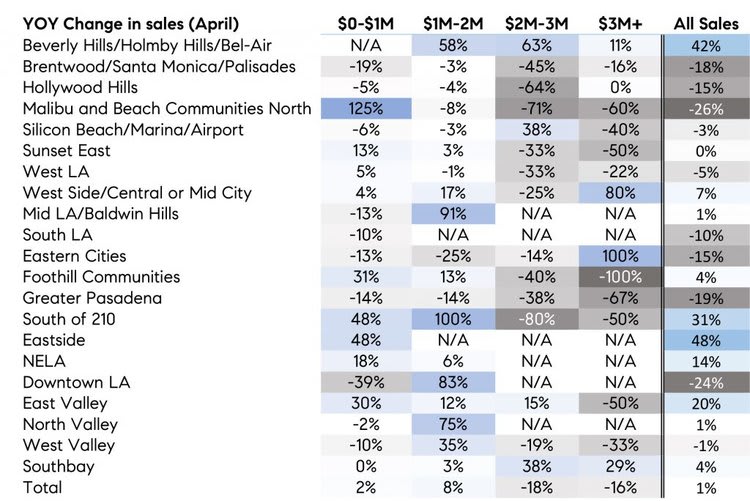

Table 1 breaks down April year-over-year changes by community and shows a wide variation in April sales changes. Most of the overall increase was driven by more units sold in the East Valley, up 20 percent representing 45 more units than last year. Other areas with improved sales include Beverly Hills, where sales were up in most all price ranges, as well as East side communities such as South of 210, East side and Northeast LA (NELA). Many West side communities, on the other hand, saw fewer sales than last year, especially Malibu which posted a relatively larger 26 percent decline. DTLA showed a notable decline as well, though the area only recently saw an increase in for-sale inventory. Interesting to note, as well, is an increase in sales of homes priced between $1 million and $2 million, which are generally up in many local communities. This trend contrasts declines seen in other parts of the state, particularly the Bay Area.

Table 1

Availability of for-sale inventory continues to trend above last year, with inventories 10 percent ahead of last April and all price ranges posting similar year-over-year differences. However, while there are more homes to choose from overall, these are not homes newly listed in April. In fact, new listings in April are below last year’s, suggesting that some of the homes that are still available for sale have been taking longer to sell. However, looking at where availability of homes fares better this year, Table 2 illustrates year-over-year changes in inventories by community and price range. Note that some areas have experienced very low inventories, accounting for larger percent increases.

Table 2

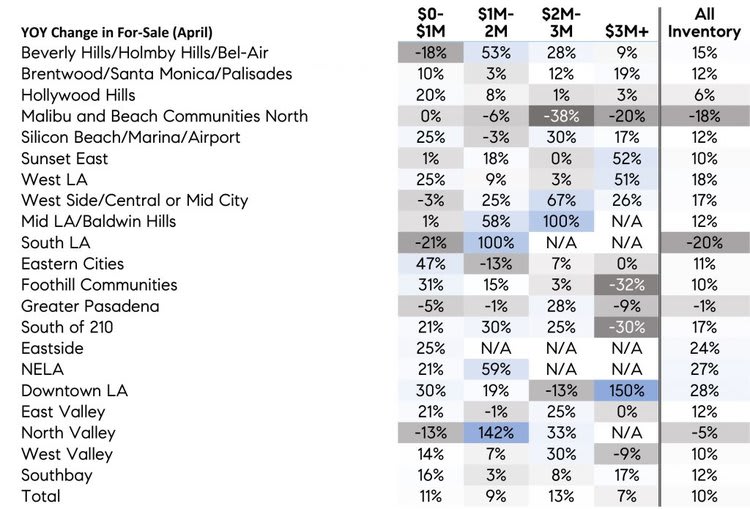

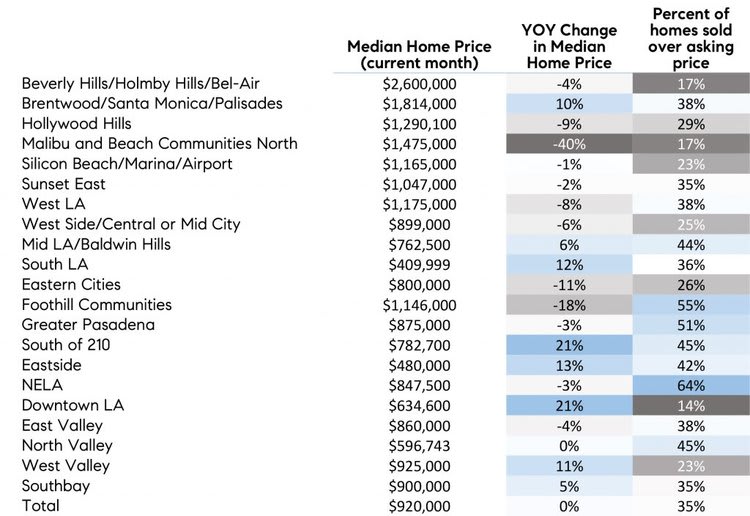

Buyer retreat in the second half of 2018 led to slowing of price growth, from a 13 percent peak seen last April to no increase this year. Figure 2 illustrates median price trends (black line) and year-over-year changes in median prices (grey line). Median home prices peaked in June of last year at $960,000 and declined to $838,000 by year-end. Note that home prices follow seasonal patterns and generally peak in summer months. Price growth has been slowing since last spring. However, not all prices remained flat throughout Los Angeles. Table 2 summarizes year-over-year changes in median prices, along with median prices and the rate of buyer competition noted by percent of homes that sold over the asking price.

Figure 2

In April, median price growth picked up in Downtown LA and areas surrounding it, South of 210 and Eastside. Price growth was also up in South LA, Mid LA/Baldwin Hills, in addition to Brentwood. Generally, however, price growth remains relatively stronger in more affordable communities.

In addition, the last column in Table 3, which shows the share of homes that sold over asking price, suggests that buyer competition remains relatively stronger in areas northeast of DTLA where about half of homes sell over asking price.

Table 3

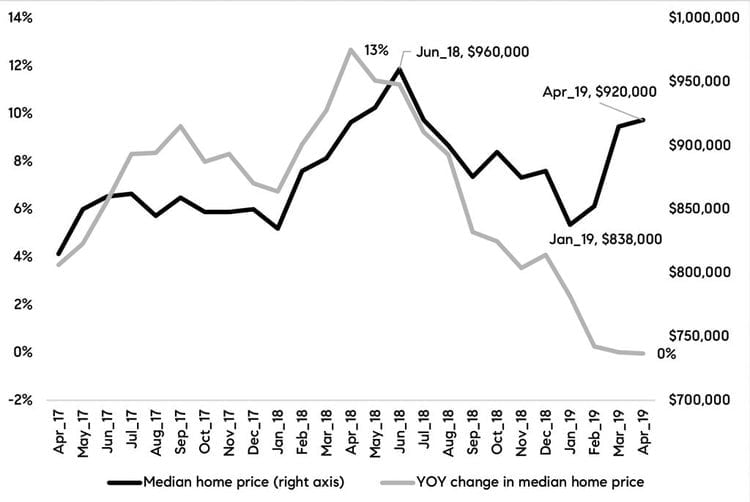

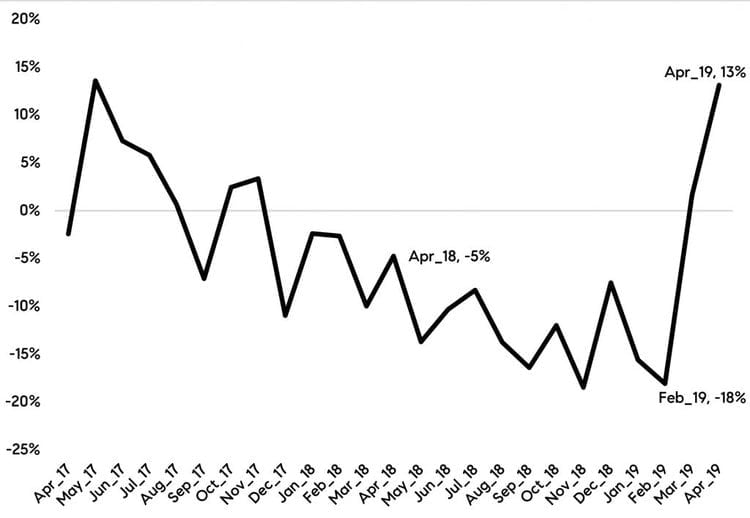

Lastly, while the Los Angeles housing market is showing signs of buyer homecoming, April’s look into the increase in the number of homes under contract suggests strong homebuying months ahead. Figure 3 illustrates the year-over-year trend in the number of homes under contract in a given month. In April, contract activity jumped 13 percent compared to last April, the first such increase since spring of 2017.

Figure 3

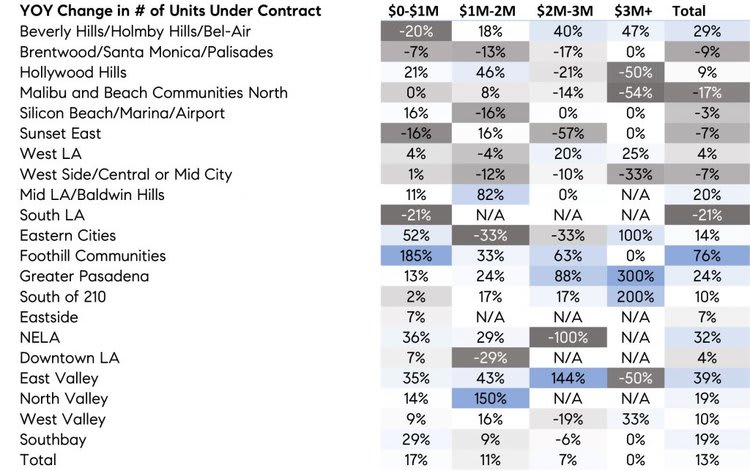

Table 4 summarizes April year-over-year changes by region and price range. Overall, the number of homes under contract in April increased 13 percent compared to last April with many regions seeing the annual jump. Two areas showing relative weakness are Malibu, South LA, and a few West side communities.

The increase is particularly notable among homes priced below $1 million, which are 17 percent ahead of last year. In other words, there was a total of 2,646 homes under contract in April, up from 2,339 last April. Again, it is reassuring that buyer activity is increasing in lower price ranges, especially given the affordability concerns the region is facing. Northeastern communities seem to be seeing most of that increase, particularly areas around the East Valley, Foothills and NELA.

Table 4